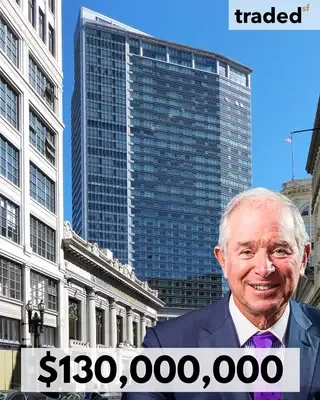

Four Seasons SF Sold to Blackstone in $130M Deal

The Bay Area Times, SF Bay Area Times - Bay Area News, California Perspectives, continues its tradition of independent journalism covering San Francisco, the Bay Area, and Northern California. In this moment of economic recalibration, the headline four seasons sf sold to blackstone in $130m deal has become a touchstone for how investors view San Francisco’s hospitality rebound and the broader urban story. As local readers know, hotels are more than lodgings; they’re barometers of tourism, business travel, and city sentiment. The market’s latest move—Blackstone’s acquisition of the Four Seasons Hotel San Francisco—signals a renewed confidence in the Bay Area’s ability to attract high-end travelers even as the region navigates housing costs, regulatory dynamics, and evolving work patterns. This article, grounded in independent reporting, unpacks what this deal means for the hotel sector, local economy, and regional investors while weaving in the context of recent market activity in San Francisco and beyond. The phrase four seasons sf sold to blackstone in $130m deal has already begun to shape conversations among hoteliers, lenders, and city leaders about the path forward for downtown San Francisco.

Understanding the deal: who sold, who bought, and what changed

The purchase of the Four Seasons Hotel San Francisco marks a high-profile milestone in the city’shotel history. Multiple outlets reported that the luxury property—a 277-key hotel located at 757 Market Street—was acquired by Blackstone for about $130 million, a price that translates to roughly $470,000 per room. The seller cited in several reports is Westbrook Partners, and the transaction is described as a pivotal step in the city’s recovery from a challenging period for urban hospitality. In this section, we lay out the core mechanics of the deal, drawing on contemporaneous reporting from reputable outlets. The initial reporting framed the transaction as a sign of renewed investor appetite for San Francisco’s upscale lodging market, even as broader market dynamics remained cautious. (sfchronicle.com)

The reporting around the transaction’s closing has evolved as journalists and market participants cross-verify details. Bloomberg’s coverage framed Blackstone’s activity as a bet on San Francisco’s comeback, noting that the acquisition aligns with a broader strategy by the firm to re-engage in urban luxury lodging markets that had cooled during the pandemic and regulatory headwinds. The published reporting also highlighted the proximity of the hotel to Union Square and the Financial District, underscoring the asset’s strategic value in a city where location—and access to meetings, conferences, and premium leisure—matters deeply. (bloomberg.com) The Real Deal later reported that Blackstone’s work to finalize the acquisition in late 2025 positioned San Francisco as a focal point for hotel investors seeking countercyclical opportunities in a recovering market. This narrative resonates with the broader market’s move toward high-end properties that can command demand as corporate travel returns and events resume. (therealdeal.com)

Key players in this narrative include Blackstone, the New York-based investment giant with a long-running track record in real estate and hospitality, and Westbrook Partners, a real estate vehicle that has owned flagship properties in major markets. The San Francisco transaction is looked at within the context of Blackstone’s portfolio strategy: acquiring a marquee property in a market with potential for operating efficiency gains and asset-level improvements, then leveraging brand partnerships, service upgrades, and targeted renovations to unlock value. Analysts and observers have stressed the potential for Blackstone to drive a modernized guest experience while contending with the city’s ongoing challenges around affordability, business travel, and local policy dynamics. (bloomberg.com)

Property specifics and immediate implications

The Four Seasons Hotel San Francisco, perched at a gateway address near Union Square, represents a luxury lodging product with strong urban appeal. The reported price point—approximately $130 million—establishes a price-per-key benchmark that observers will watch as a signal of both asset quality and market sentiment. Market participants have noted that even at a price below historic highs for comparable assets, the deal underscores a willingness among sophisticated buyers to invest in urban luxury when they anticipate a long-tail rebound in convention, business travel, and discretionary leisure. While the sale price is widely reported as an approximation, the consensus among outlets has been that it reflects a meaningful, if not spectacular, pricing signal for a market still recalibrating from pandemic-era disruptions. The deal’s completion was timed to align with an uptick in regional activity, including conferences, technology sector gatherings, and other events that historically buoy downtown hotel demand. (sfchronicle.com)

In addition to the core hotel asset, observers are watching related market signals: the broader pace of hotel transactions in downtown San Francisco, including the notable Parc 55 and Hilton San Francisco Union Square sale to Newbond Holdings and Conversant Capital for roughly $408 million. Those properties, with a combined scale far exceeding the Four Seasons deal in dollar terms, reflect a market in flux—one that is revaluing assets downward from peak pre-2019 numbers but with a long-run belief in urban revival. The juxtaposition of a single-asset purchase at $130 million with multi-property dispositions at a higher aggregate price helps frame an uneven but aspirational recovery path for the city’s hospitality ecosystem. (sfchronicle.com)

The closing and what comes next

Since the initial reports, market participants have tracked the trajectory toward closing and post-closing plans. By December 2, 2025, sources tracking market activity reported that Blackstone’s acquisition of the Four Seasons San Francisco was finalized, marking a historic moment as the firm completes its first hotel purchase in the city in roughly a decade. The closing places Blackstone at the center of a broader Bay Area investment narrative, reinforcing the idea that luxury hospitality can be a fulcrum for urban recovery when paired with disciplined asset management and strategic capital investments. The implications extend beyond the hotel’s doors, potentially affecting supplier ecosystems, local hiring, and ancillary services that rely on a steady stream of high-end guests. (cremarketbeat.com)

"Cities are built on confidence," a well-worn refrain in urban economics, and the San Francisco story continues to be shaped by the confidence of private capital, corporate travelers, and local leadership. The Four Seasons deal, in this sense, is less a single transaction than a signal about the direction of the city’s long-run competitiveness in the global travel economy.

Market context: San Francisco’s hotel landscape in 2025

To understand the significance of this deal, it helps to look at the broader hotel landscape in San Francisco during 2024 and 2025. The city has faced a confluence of factors that affect hotel demand: a rebound in business travel tied to tech and venture activity, ongoing concerns about housing affordability and regulatory constraints, and the return of conferences and large-scale events that historically buoy downtown properties. The sale of Parc 55 and Hilton San Francisco Union Square for $408 million—driven by Newbond Holdings and Conversant Capital—illustrates investor appetite for scale and asset repositioning in the downtown core, even as questions about occupancy recovery and room rates persist. The juxtaposition of a high-profile luxury acquisition with a larger portfolio sale highlights a market increasingly comfortable with selective bets on prime assets in a post-pandemic climate. (sfchronicle.com)

A closer look at the luxury segment

Luxury hotels in San Francisco have often proven more resilient than other segments, given the city’s draw for international travelers, high-spending domestic guests, and events that target premium markets. The Four Seasons San Francisco, positioned on Market Street near Union Square, benefits from demand for convention and corporate travel for meetings, product launches, and board retreats. Blackstone’s decision to pursue this asset aligns with a trend in which large investment firms identify assets with durable branding, strong service platforms, and opportunities for amenities upgrades to drive RevPAR (revenue per available room) growth over the longer term. Analysts cautioned that the immediate post-close period would require careful operating discipline to navigate shifting demand patterns, cost inflation, and operational headwinds typical of urban luxury hotels. Still, the consensus in industry commentary was that the asset’s brand, location, and potential for value creation justified the investment thesis. (bloomberg.com)

The effect on the local labor market and city services

Downtown hotel activity has direct implications for local employment, supplier networks, and city tax revenue. With the Four Seasons entering Blackstone’s portfolio, there is potential for job stability and new opportunities in hotel operations, food and beverage, events staffing, and maintenance. However, like many Bay Area employers, the hotel industry must navigate a competitive labor market, wage pressures, and ongoing debates about permitting, traffic, and urban planning. Local officials have often framed hotel investment as a path to revival, while also pressing for broader neighborhood resilience and inclusive growth. The city’s officials have welcomed the broader recovery narrative, citing renewed visitor interest and the importance of maintaining San Francisco’s status as a premier destination for meetings and leisure alike. (bloomberg.com)

Why this deal matters for Bay Area investors and the broader economy

The Four Seasons SF sale to Blackstone is more than a single hotel transaction; it’s a data point in a larger conversation about how the Bay Area’s regional economy and investor community respond to post-pandemic opportunities. Several themes are worth noting.

-

Confidence in urban demand: The market has shown that premium properties in gateway cities can attract patient capital even when macroeconomic conditions are unsettled. The sale status and subsequent closing indicate a belief that San Francisco’s core demand—business, convention, and luxury leisure—will rebound in a way that preserves asset value over the long horizon. This is consistent with Bloomberg’s reporting on Blackstone’s broader comeback bet for San Francisco’s luxury lodging sector. (bloomberg.com)

-

Price signals in a compressed market: The approximate $130 million price, spread over 277 keys, carries significance for pricing benchmarks in a constrained urban hotel market. In late 2025, observers have described the price per key as a meaningful indicator of how buyers assess value in a post-pandemic city with ongoing cost-of-capital considerations. The per-key figure has become part of ongoing market dialogue among developers, brokers, and lenders. (sfchronicle.com)

-

Competitive landscape and asset repositioning: The parallel storyline of Parc 55 and Hilton San Francisco Union Square selling for $408 million to a joint venture demonstrates a concurrent market move toward larger platforms and asset repositioning. The contrast between a single luxury asset and a broader, multi-asset disposition underscores how capital is being deployed in ways that optimize risk-adjusted returns. It also raises questions about how Blackstone and other buyers could approach renovations, branding, and service models to maximize daily rate during a recovery phase. (sfchronicle.com)

-

Implications for lenders and developers: The SF market’s renewed activity invites lenders to reassess underwriting for urban luxury hotels, with attention to occupancy recovery curves, franchise performance, and potential inflation in operating costs. Analysts suggest that the quality of a property’s brand, management, and adjacent demand drivers will determine how quickly a project can move from stabilization to growth, especially in a city where permitting and cost structures remain complex. The Four Seasons deal provides a case study for how urban centers can attract capital with selective, value-creating opportunities. (bloomberg.com)

A data-driven look: comparison table of recent SF hotel transactions

| Property / Deal context | Location and key metrics | Seller | Buyer | Reported price / valuation | Notable context |

|---|---|---|---|---|---| | Four Seasons Hotel San Francisco | 277 rooms, 757 Market Street | Westbrook Partners | Blackstone | About $130 million (approx. $470k per room) | Core luxury asset; first SF hotel purchase by Blackstone in a decade; closing reported December 2, 2025. (sfchronicle.com) | | Parc 55 and Hilton San Francisco Union Square | 1,921 + 1,024 rooms (approx total 2,945) | Parc 55 and Hilton assets combined | Newbond Holdings & Conversant Capital | $408 million total | Large portfolio sale signaling market-wide repositioning; context for single-asset valuations. (sfchronicle.com) | | San Francisco market takeaway | — | — | — | — | These juxtaposed transactions illustrate a market widening the lens on urban luxury and scale, as well as potential future capex needs for post-closure enhancements. (therealdeal.com) |

Note: While the Four Seasons deal is consistently described in the reported sources as approximately $130 million, the official sale price was not always disclosed publicly, and various outlets have reported the figure as part of a near-consensus market narrative. Readers should treat the $130 million as the reference point used by multiple reporters in late 2025, with some variation in exact closing price depending on the final accounting and timing. For the most precise figure, the official transaction filing or city real estate records would be definitive. (sfchronicle.com)

The investor perspective: what Blackstone sees in San Francisco

Blackstone’s involvement in the Four Seasons deal aligns with its long-running strategy of acquiring high-quality assets in select markets and leveraging capital to unlock hidden value through operating enhancements, renovations, and asset management. The luxury hotel sector in urban cores has historically offered a mix of steady demand and sensitivity to macro cycles; in 2025, a stronger knowledge economy and a resurging conference circuit have helped tilt risk-return assessments in favor of such acquisitions. Analysts have highlighted that Blackstone’s approach tends to emphasize rigorous cost controls, targeted capex, and a focus on guest experience upgrades that can improve margins as the market heals. The SF market’s particular dynamics—city leadership, tourism profile, and ongoing concerns around urban vitality—mean that asset-level strategies matter as much as macro market timing. (bloomberg.com)

City leadership has framed this investment as a vote of confidence in San Francisco’s long-term appeal. Mayor Daniel Lurie and other city officials have welcomed capital inflows that can catalyze job creation, hotel occupancy, and related economic activity. While the city continues to navigate structural headwinds—housing affordability, policy complexity, and the cost of living—the luxury hotel sector has remained a focal point for investors seeking durable demand anchored by international travelers and high-end business visitors. In this sense, the Four Seasons deal sits within a broader narrative of urban resilience and private capital’s role in catalyzing renewal. (sfgate.com)

Impact on the Bay Area economy: jobs, tourism, and the business ecosystem

Beyond the immediate hotel asset, the Four Seasons sale interacts with a broader set of regional economic channels. Tourism is a critical driver for local hospitality jobs, restaurant activity, retail sales, and cultural institutions. In a city that has faced headwinds from high living costs and a labor market shifting between remote and in-person work, the luxury-hospitality sector has a special role in signaling that San Francisco remains a competitive destination for meetings, conferences, and premium leisure. The economic multiplier effect of a high-end hotel transaction includes direct employment at the property, indirect effects through suppliers and ancillary services, and induced effects from increased guest spending in nearby neighborhoods. These channels are especially salient given the Bay Area’s mix of tech-driven corporate travel, tourism, and convention activity that historically concentrated value in downtown corridors. (bloomberg.com)

Local journalists have emphasized how such deals affect the city’s brand narrative. San Francisco has long benefited from a reputation as a global hub for technology, culture, and innovation. The revival of downtown hotel demand is often tied to a city’s ability to host large-scale events, attract international travelers, and demonstrate through public-private collaboration that urban ecosystems can adapt to changing demographic and economic realities. This deal—coupled with contemporaneous activity in the market—contributes to a broader sense that the city is repositioning itself for sustained competitiveness, even as it continues to address policy and infrastructural questions that shape day-to-day life for residents and visitors alike. (bloomberg.com)

Case studies and lessons for readers

- Luxury branding and guest experience investments: The asset class’s resilience rests, in part, on the ability to maintain an aspirational brand while delivering premium guest experiences. Blackstone’s potential post-close strategy could include targeted refurbishments, technology-driven guest services, and refined F&B offerings to sustain profitability as demand recovers. While specifics for the Four Seasons property post-close aren’t exhaustively published, this framework aligns with how private equity-backed hospitality plays typically unfold in major markets. (bloomberg.com)

- Market sequencing: The juxtaposition of the Four Seasons deal with the Parc 55 and Hilton Union Square sale demonstrates how investors are balancing risk and opportunity. The single-asset premium play sits alongside larger-scale repositioning moves, suggesting a diversified approach to urban hotel investments as the recovery matures. For practitioners, it highlights the importance of understanding both asset-specific fundamentals and citywide demand dynamics. (sfchronicle.com)

- City policy and investor sentiment: The SF market’s trajectory is inextricably linked to city policy, permitting processes, and urban planning decisions. Investors will watch how San Francisco addresses permitting timelines, construction costs, and the governance environment as part of their long-term value creation plan for properties like the Four Seasons. The sentiment conveyed by major deals can influence lender appetite and the availability of capital for future projects. (bloomberg.com)

Frequently asked questions: clarifying the Four Seasons SF deal

Q: What exactly was the sale price of the Four Seasons San Francisco? A: The consensus in major reporting circles is that Blackstone purchased the Four Seasons San Francisco for about $130 million. The exact closing price was reported as approximately $130 million in multiple outlets, with standard industry caveats that the official price may be disclosed differently in formal filings. (sfchronicle.com)

Q: How many rooms does the Four Seasons San Francisco have? A: The property is described as a 277-room luxury hotel, located at 757 Market Street in downtown San Francisco. This configuration helps explain the per-room valuation figures that circulated in reporting at close. (sfchronicle.com)

Q: Who were the main parties involved? A: The seller was Westbrook Partners, with Blackstone serving as the buyer. The broader market conversation also involves other major players in San Francisco’s hospitality space, such as Newbond Holdings and Conversant Capital, which completed a separate, larger hotel sale in the downtown area around the same period. (sfchronicle.com)

Q: What does this mean for San Francisco’s hotel market going forward? A: While immediate post-close performance will depend on a range of factors, industry commentary frames this as a bullish signal for urban luxury properties and a sign that hotel demand in San Francisco is stabilizing and potentially expanding as conferences, corporate travel, and premium leisure guests return. The deal sits within a broader context of city-wide investment activity, which observers view as a positive indicator for future asset valuations and market liquidity, even as the city continues to address structural challenges. (bloomberg.com)

Q: Will this deal affect local job opportunities? A: Large hotel transactions often bring near-term employment stability and can open doors for hospitality personnel, suppliers, and event services as renovations or repositioning plans are implemented. In the San Francisco context, investment activity in downtown hotels typically translates into a mix of direct employment at the property and indirect benefits through the surrounding business ecosystem. The precise impact will depend on Blackstone’s management plan and any capital improvement program they implement. (bloomberg.com)

The SF Bay Area Times perspective: context, tone, and editorial approach

As SF Bay Area Times reports, independent journalism covering San Francisco, the Bay Area, and Northern California, we aim to provide nuanced, data-informed analysis of major market shifts like the Four Seasons SF sold to Blackstone in $130M deal. Our coverage integrates central facts from credible sources, considers the broader regional economy, and reflects the local reader’s interest in how national investment trends intersect with city life. The Bay Area’s unique mix of tech-driven growth, cultural vitality, and urban policy creates a distinctive backdrop for luxury-hospitality moves such as this one. We will continue to monitor the market’s evolution and publish updates as new data and outcomes become available. The ongoing conversation around a single high-profile asset is part of a larger narrative about San Francisco’s path to revitalization and resilience. (bloomberg.com)

Children's dentist is not only about taking care of their teeth, it's also about taking care of their habits.

By keeping a close eye on San Francisco’s luxury-hospitality investments, we’re helping readers understand how city life, business, and culture intertwine to shape daily experience and long-term opportunity.

Rich takeaways for readers and stakeholders

- San Francisco’s luxury hospitality market remains a magnet for sophisticated capital, signaling confidence in long-term urban demand despite near-term headwinds. The Four Seasons deal is a prominent example that aligns with similar high-profile transactions in the downtown corridor. (bloomberg.com)

- Price signals in a compressed market can still reflect value, especially when anchored by a brand with durable appeal and a city location that remains highly desirable for business and leisure. The approximate $130 million price and per-key metrics provide a lens into how investors are benchmarking value in 2025. (sfchronicle.com)

- The broader market context—exemplified by Parc 55 and Hilton Union Square’s sale—illustrates that investors are testing both single-asset opportunities and portfolio strategies to maximize returns in an evolving urban hotel landscape. (sfchronicle.com)

A closing reflection: where SF goes from here

The Four Seasons SF sale to Blackstone represents a milestone moment that many Bay Area observers will revisit in the months ahead. It is not merely about a price tag on a single asset; it is about signaling how private capital interprets San Francisco’s recovery trajectory and how the city can harness that momentum for broader economic and cultural renewal. The deal’s closing confirms a shared belief among investors, city leaders, and industry participants that the Bay Area remains a magnet for global travelers, a center of innovation, and a place where scale investment can align with urban revitalization. As our reporting continues, SF Bay Area Times will monitor post-close plans, occupancy trends, rate dynamics, and the ripple effects across employment and local commerce, providing readers with timely, grounded analysis grounded in the realities of a city that never stops evolving.