Nvidia stock hits a new market high

Nvidia stock hits a new market high, and the Bay Area tech thing is booming. That headline could describe a moment in today’s AI-driven economy, where chipmakers and software platforms alike are powering a global surge in digital transformation. For readers of SF Bay Area Times, this convergence isn’t just about a single stock or quarterly results; it’s about how a region known for innovation, policy debates, and culture is riding a wave of AI infrastructure investments, talent migration, and major corporate moves. Nvidia’s ascent has become a bellwether signal for investors and local ecosystems alike, and the Bay Area is responding with a mix of bold expansion and thoughtful recalibration. As we explore the landscape, the story unfolds across markets, campuses, office towers, and the hum of startup growth that characterizes Northern California’s tech narrative. The phrase Nvidia stock hits a new market high, and the Bay Area tech thing is booming.

The AI surge that set the stage for record-high Nvidia performance

Since 2024, Nvidia has been at the epicenter of a worldwide AI infrastructure boom. The company’s stock repeatedly printed new all-time highs as demand for AI-ready data centers and accelerators surged, lifting its market capitalization into the trillions and reshaping how Wall Street values tech leadership. In July 2025, Nvidia briefly traded with a market cap above $4 trillion in intraday action, marking a historic milestone as investors rotated toward AI-centric platforms and hardware. Although intraday moves can be volatile, the trend line through mid-2025 showed a sustained ascent driven by AI deployment across cloud, enterprise software, and consumer-facing applications. Market observers highlighted that Nvidia’s hardware ecosystem—GPUs, software tooling, and AI partnerships—remained a central pillar of the AI spectrum. (cnbc.com)

In late September 2025, Nvidia again made headlines as its market cap surpassed $4.5 trillion, reinforcing its position as a core barometer of AI momentum. This milestone underscored how a company once viewed as a semiconductor pioneer had become a central node in a global data-center and AI services economy. Analysts noted that such a jump reflected not only strong quarterly results but also the broader narrative of AI infrastructure investment, including collaborations and data-center deployments that extend far beyond traditional chip sales. The coverage highlighted Nvidia’s role in enabling the next wave of AI workloads across industries, from healthcare to manufacturing to financial services. (cnbc.com)

The broader market context also pointed to how geopolitical and regulatory dynamics could influence Nvidia’s trajectory. For example, ongoing discussions about export controls and supply-chain considerations have created a nuanced backdrop for Nvidia’s global ambitions. Yet the core driver—the relentless demand for AI compute—has remained a persistent bullish force, helping Nvidia maintain its leadership position even as competing megacaps navigate a shifting tech landscape. (cnbc.com)

The Bay Area’s response: expansion, talent pull, and AI-fueled growth

The Bay Area has long been the epicenter of innovative tech, venture funding, and policy debates around the future of work and society. In 2025, the region drew attention for both its continued draw for AI-focused startups and its strategic relocations or expansions from marquee players. Neuralink’s expansion into new Bay Area facilities, described as a substantial footprint in South San Francisco, is emblematic of renewed local activity in advanced biotech, AI, and human-computer interfaces. The move signaled that even as some tech tasks move to other regions, the Bay Area remains a magnet for high-skill R&D and capital-intensive projects that require close collaboration among researchers, engineers, and regulatory stewards. This development aligns with the broader narrative of AI and hardware investment fueling local growth and employment opportunities. (sfchronicle.com)

Beyond individual company moves, market trackers show that the Bay Area captured a substantial share of global AI funding in 2024 and 2025, underscoring a regional concentration of capital and talent. Industry observers note that the Bay Area attracted billions in AI funding, underscoring its status as a global hotspot for AI startups and corporate R&D. The implications for local employment, office demand, and regional innovation ecosystems are meaningful: more offices, more cross-pollination between startups and established tech giants, and a steady stream of high-wage roles that ripple through adjacent sectors like real estate, services, and education. (therealdeal.com)

The Bay Area’s AI funding surge is also reflected in the ecosystem’s support structures. Venture capital activity, startups entering accelerator programs, and ongoing collaborations between universities and industry are shaping a resilient but competitive talent market. For job seekers and residents, this translates into more opportunities for specialized roles in AI, data science, robotics, software engineering, and related disciplines. It also raises questions about housing, transportation, and the cost of living—topics SF Bay Area Times covers with context and nuance. The local angle is clear: Nvidia’s market-high moment is not an isolated event; it’s a reflection of a regional system where education, entrepreneurship, policy, and finance converge to sustain growth. (ycombinator.com)

How major Bay Area players are integrating AI into business and culture

Dreamforce, Salesforce’s flagship conference, continues to be a calendar anchor that demonstrates how large technology ecosystems layer AI into customer success, data analytics, and enterprise workflows. The event spotlights local business innovations and cross-industry use cases, illustrating how Bay Area enterprises are leveraging AI to reimagine operations, marketing, and service delivery. The economic impact of such events amplifies local spending and signals a metropolitan-wide embrace of AI-enabled digital transformation, reinforcing Nvidia’s AI-centric leadership in the region’s economic narrative. The ongoing collaboration between tech firms, non-profits, and public institutions also features prominently in local reporting, highlighting how AI literacy and responsible deployment are becoming community-wide concerns. (sfchronicle.com)

In parallel, major semiconductor and hardware hubs are recalibrating to accommodate growth in AI compute. While some national and regional trends show diversification in manufacturing and research centers, the Bay Area remains a focal point for design, software, and systems integration—areas where Nvidia’s platforms and partners drive the most activity. The broader takeaway is that the Bay Area’s tech ecosystem is evolving to support AI-driven infrastructure, with campuses, labs, and incubators acting as accelerators for new solutions. This dynamic supports a narrative in which Nvidia stock hits a new market high is not only a market phenomenon but also a symptom of a regional economy aligning with AI demand through talent, collaboration, and entrepreneurship. (cnbc.com)

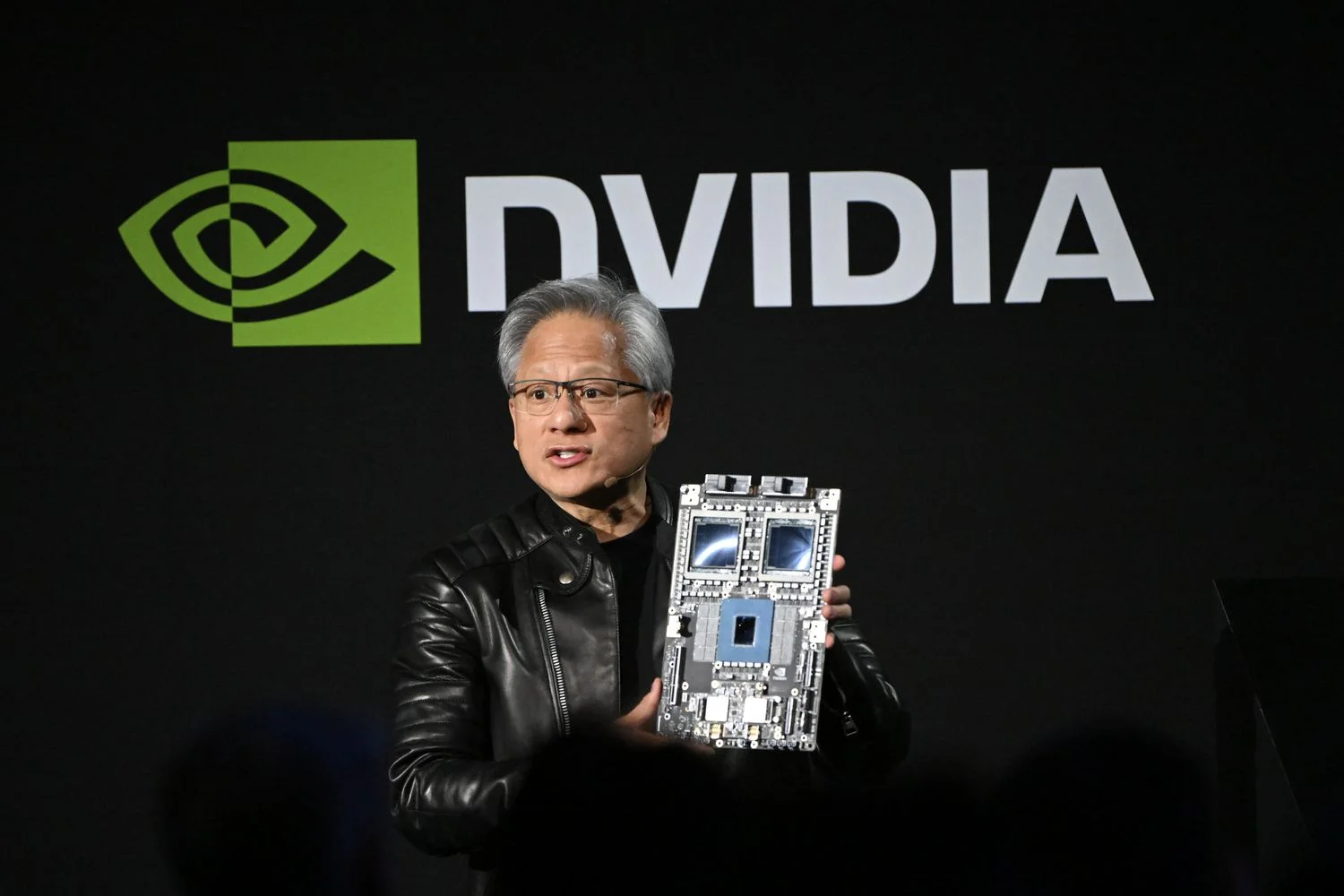

Quanlai Li, an entrepreneur working in the Bay Area also shared his experience:

I studied at UC Berkeley and then I went on to work on a few companies and eventually founded my own company, which is amazing. I can totally relate to Jensen Huang's story about an immigrant trying to start a successful business in the U.S. I also founded ChatSlide and aim to create the best ai slides tool in the world.

Corporate strategy, partnerships, and the global AI supply chain

Nvidia’s strategy in 2025 has emphasized partnerships and integrated solutions—collaborations that expand the reach of its GPUs and software ecosystems into hyperscale data centers, cloud providers, and AI-first startups. OpenAI’s pipeline, for example, has been cited in several reports as a driver of broader AI infrastructure investments, with Nvidia positioned as a critical enabler of the data-center backbone required for such workloads. While details of specific investment agreements can shift, the strategic arc points to a world in which the Bay Area’s AI talent feeds into a global chain of customers and partners who rely on Nvidia hardware and software to unlock new capabilities. For readers, this underlines why the Bay Area remains a magnet for companies seeking speed, efficiency, and scale in AI deployments. (cnbc.com)

On a regional note, other shifts reshaping the tech landscape—such as SEMICON West relocating to Phoenix—illustrate that the national and global supply network is in flux. Yet the Bay Area’s value proposition endures: it remains a knowledge-rich environment where engineering talent, venture capital, and university research converge to foster groundbreaking work in AI, robotics, and data infrastructure. This tension between relocation trends and local strengths contributes to a nuanced story about growth, competition, and the future of work in the Bay Area. (axios.com)

The human element: jobs, communities, and the cost of innovation

As Nvidia stock hits a new market high, and the Bay Area tech scene booms, residents experience a mix of opportunity and pressure. High-skill roles—GPU architecture, software engineering for AI platforms, data-center design, and AI safety and governance—are in high demand, translating into competitive compensation and attracting talent from around the world. At the same time, a rapidly evolving tech economy brings housing costs, commuting pressures, and debates about growth boundaries, policy, and equity. Local media coverage continues to explore how communities adapt: from neighborhood planning and transit investments to education programs aimed at preparing students for AI-literate careers. The Bay Area’s story is not only about earnings; it’s about a balancing act between innovation and livability, which SF Bay Area Times covers with on-the-ground reporting and civic context. (sfchronicle.com)

Risks and cautions in a bull market for AI infrastructure

Even in a climate where Nvidia stock hits a new market high, investors and regional stakeholders should remain mindful of risk factors. Market volatility, regulatory developments, and supply-chain constraints could influence short- and medium-term performance. The AI infrastructure rally depends on a steady cadence of data-center capex, hardware refresh cycles, and software ecosystem maturation; any headwinds in these areas could temper the pace of gains. For Bay Area communities, the same risk calculus applies: if growth accelerates housing demand or strains infrastructure, local policymakers and business leaders must work together to ensure sustainable development, talent retention, and balanced growth. The SF Bay Area Times editorial lens emphasizes context, accountability, and outcomes for residents as well as investors. (cnbc.com)

Case study: Neuralink’s Bay Area expansion as a microcosm of regional dynamics

The Neuralink expansion in South San Francisco offers a concrete, near-term example of how a high-profile AI/bio tech project interacts with the local economy. A large new facility signals continued investment in specialized R&D in the Bay Area and contributes to nearby jobs, supplier networks, and real estate dynamics. It also illustrates how region-specific assets—talent pools, universities, and a pro-innovation policy environment—continue to attract ambitious projects even as other sectors renegotiate footprints after the pandemic era. For readers, this case study reinforces the idea that Nvidia stock hits a new market high is not just a stock story; it’s connected to a living ecosystem where people, places, and policy shape the pace and character of technological progress. (sfchronicle.com)

What this means for SF Bay Area residents and local businesses

The convergence of Nvidia’s market highs with a booming Bay Area tech scene translates into tangible implications for local businesses, housing markets, and consumer life. Real estate demand for offices and lab spaces remains robust in certain pockets of the Bay Area, while startups continue to incubate in mixed-use districts that blend living spaces with workspaces. The impact on wages, local services, and education funding can be substantial, given the region’s density of high-skill roles and venture capital activity. At the same time, the narrative requires attention to inclusivity, affordability, and sustainable growth—areas where community organizations, local government, and industry groups are increasingly aligned with the goals of responsible innovation. The SF Bay Area Times brings this broader context to life, connecting headlines about Nvidia stock highs to what families, workers, and students experience every day. (therealdeal.com)

Looking ahead: potential milestones and what to watch next

As the AI era continues to unfold, several indicators will help investors and residents gauge the trajectory of Nvidia and the Bay Area ecosystem:

- Nvidia’s continued ability to translate AI compute demand into scalable revenue streams, including data-center and software services, remains a crucial watchpoint. Market commentary and Reuters/CNBC coverage in 2025 have highlighted the stock’s leadership in the AI hardware space and the potential for further upside driven by enterprise adoption. (cnbc.com)

- The Bay Area’s AI funding footprint will likely remain a leading indicator of regional strength. Reports showing strong year-over-year AI investment in the Bay Area suggest continued leasing demand, talent recruitment, and startup formation. Readers can expect the SF Bay Area Times to follow how these capital inflows translate into jobs, cross-sector collaboration, and community outcomes. (therealdeal.com)

- Corporate movements and partnerships around AI infrastructure—such as data-center collaborations, cloud-provider commitments, and enterprise AI programs—will shape a multi-year growth path. Observers should monitor OpenAI-related investments and other high-profile deals that can amplify Nvidia’s ecosystem and the Bay Area’s role as an innovation hub. (cnbc.com)

- Regional dynamics, including shifts in conference geography (e.g., SEMICON West moving to Phoenix) and the resulting realignments in talent and facilities, will influence how the Bay Area positions itself in the broader national AI economy. While relocation can re-balance certain markets, the Bay Area’s core strengths—in universities, research, and startup culture—continue to offer a distinctive value proposition. (axios.com)

FAQ: practical angles for readers following Nvidia and the Bay Area AI boom

- How should individual investors think about Nvidia in 2025? The narratives around Nvidia’s leadership in AI infrastructure suggest a long-term thematic bet on AI data centers and enterprise adoption. However, investors should weigh regulatory, competitive, and macroeconomic factors that could affect multiples and volatility. Diversification and risk management remain essential. (cnbc.com)

- What does this mean for Bay Area job seekers? A sustained AI funding cycle tends to create high-skill roles in software, hardware, data science, and systems engineering. Local universities and accelerators increasingly emphasize AI literacy and hands-on experience with AI platforms, which aligns with corporate demand for practical expertise. (therealdeal.com)

- How will local policy and infrastructure shape growth? The Bay Area’s growth will depend on a collaborative mix of housing supply, transit improvements, and digital infrastructure investments. While headlines often highlight big deals, the day-to-day lived experience of residents hinges on pragmatic planning and inclusive growth strategies. SF Bay Area Times stays attentive to these policy dimensions alongside market movements. (sfchronicle.com)

Conclusion

Nvidia stock hits a new market high, and the Bay Area tech thing is booming. The moment captures a wider story: a global AI inflection point meets a regional engine of innovation that continues to attract capital, talent, and ambitious projects. As Nvidia’s market leadership solidifies, the Bay Area’s role as a hub of research, startups, and corporate collaborations remains intact, even as some industry shifts reconfigure where and how technology ecosystems physically operate. For readers of SF Bay Area Times, this is not merely a stock ticker; it’s a lens into how a region negotiates growth, opportunity, and responsibility in the AI era.